XRP Price Prediction: Will XRP Hit $3 Amid Bullish Breakout?

#XRP

- Technical Breakout: XRP is trading above its 20-day MA with narrowing MACD bearishness.

- News Catalysts: ETF speculation and Ripple's European expansion fuel bullish sentiment.

- Price Targets: Analysts project short-term resistance at $3, with higher targets up to $38.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

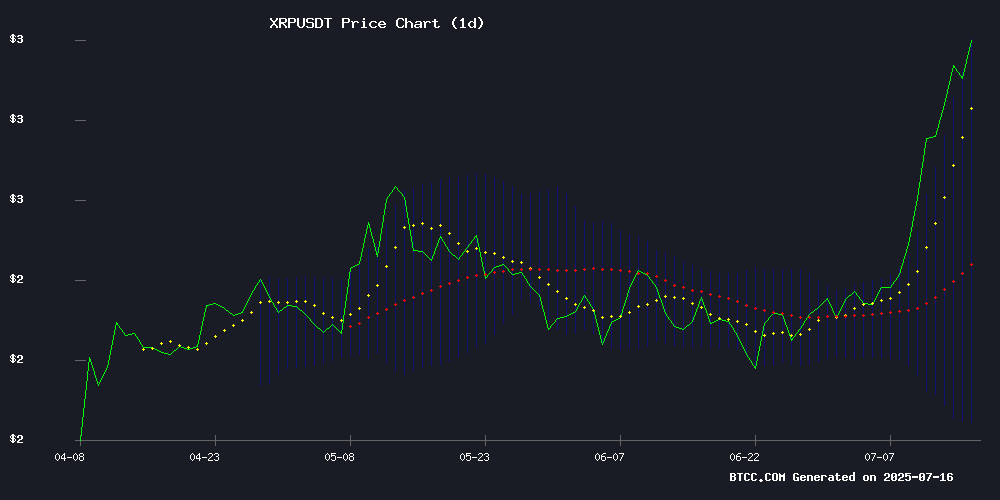

According to BTCC financial analyst Emma, XRP is currently trading at 2.9053 USDT, above its 20-day moving average of 2.4382, indicating a bullish trend. The MACD shows a narrowing bearish momentum with values at -0.2940 (MACD line), -0.1877 (signal line), and -0.1063 (histogram). Bollinger Bands suggest potential volatility, with the upper band at 3.0089, middle at 2.4382, and lower at 1.8675. A break above the upper band could signal further upside.

XRP Market Sentiment: Optimism Fuels Rally

BTCC financial analyst Emma notes that positive news around XRP, including ETF speculation, institutional adoption, and technical breakouts, is driving market optimism. Key headlines highlight targets of $10, $12, and even $38, supported by Ripple's expansion in Europe and whale accumulation. The sentiment aligns with technical indicators, suggesting strong bullish momentum.

Factors Influencing XRP’s Price

California Enlists Crypto Execs to Modernize State Operations

California Governor Gavin Newsom has launched the California Breakthrough Project, tapping executives from Coinbase, Ripple, and MoonPay to streamline government processes. The initiative, announced at Ripple's San Francisco headquarters, targets inefficiencies in procurement, hiring, and service delivery through public-private collaboration.

The advisory group will leverage California's dominance in AI innovation—home to 32 of the world's top 50 AI firms—to pilot new solutions while maintaining privacy standards. Newsom paired the effort with Executive Order N-30-25, mandating faster hiring cycles and simplified IT procurement across state agencies.

XRP Targets $10 After Breaking Key Resistance

XRP has surged past a critical technical barrier, with analysts now eyeing a potential rally to $10. The token trades at $2.93, up 4.62% on the day and 29.55% for the week, as trading volume jumps 26%.

Egrag Crypto identifies a decisive breakout above the 1.414 Fibonacci Circle from December 2024 as the catalyst. This opens a path toward $6.50 in the near term, with $17-$35 possible if bullish momentum sustains. The analyst recommends Dollar Sell Averaging to capitalize on the uptrend.

Market data confirms growing conviction. CoinGlass reports a 29.44% volume spike to $20.33 billion, while open interest rises 7.67%. The steady 0.0125% funding rate suggests measured optimism without excessive leverage.

XRP Price Eyes All-Time High as Bulls Target $4.80 Breakout

XRP is flashing bullish signals again, with prominent market analyst Ali Martinez predicting a breakout toward new all-time highs. Martinez, who closely tracks technical patterns in crypto markets, noted that XRP is "screaming all-time highs" and could be gearing up for a rally to $4.80, provided it clears a crucial resistance.

Currently trading around $2.87, XRP has retraced slightly after briefly testing the $3 resistance level. This resistance has remained intact since January 2025, forming the upper boundary of a parallel channel where XRP has ranged between $2 and $3 for more than seven months.

Despite several failed breakout attempts, XRP’s consistent defense of the $2 support zone demonstrates strength on the part of the bulls. Martinez believes a decisive close above $3 would act as a catalyst for XRP to revisit and exceed previous price records. The next immediate resistance lies at $3.40, a level that rejected XRP’s advance in January 2025. Above that, the 2018 all-time high of $3.80 stands as another key psychological and technical barrier.

Ripple Anchors RLUSD Expansion in Luxembourg, Eyes European Growth Under MiCA Framework

Ripple has strategically chosen Luxembourg as its European hub for stablecoin operations, signaling a major push into the continent's regulated crypto markets. The move positions XRP for expanded utility as the company files for an Electronic Money Institution license with Luxembourg's CSSF regulator.

Compliance with the EU's Markets in Crypto-Assets (MiCA) framework remains central to Ripple's strategy. The newly established Ripple Payments Europe SA entity has already begun recruiting compliance specialists, underscoring the company's long-term commitment to the region. Luxembourg's robust banking infrastructure and recent EMI approvals create an ideal regulatory sandbox.

The RLUSD stablecoin launch will test Europe's appetite for institutionally-backed digital assets. Market observers note this development could catalyze broader XRP adoption across payment corridors, particularly if Ripple secures first-mover advantage under MiCA's stablecoin provisions.

Analyst Sets $12 Target for XRP Amid Market Pullback, Spot ETF Speculation

XRP faced a 2% decline to $2.92 amid broader crypto market weakness, though analysts remain bullish. A conservative $12 price target hinges on breaching key resistance levels, with traders holding support at $2.90 despite volatility between $3.02 and $2.81.

Market sentiment fluctuates as investors digest hotter-than-expected US CPI data and profit-taking. Notably, speculation about BlackRock potentially filing for a spot XRP ETF has injected optimism, suggesting institutional interest could fuel the next rally.

The asset's trajectory mirrors crypto market cycles—brief retracements followed by explosive moves. XRP's ability to maintain support during this pullback signals underlying strength, with the $12 forecast contingent on overcoming immediate technical barriers.

3IQ’s XRP ETF Hits $50M in AUM Within a Month on TSX, Backed by Ripple’s Seed Investment

Canada-based asset manager 3iQ has achieved a significant milestone with its XRP Exchange-Traded Fund (XRPQ), amassing over $50 million in assets under management (AUM) within weeks of its debut on the Toronto Stock Exchange. The fund’s rapid growth underscores surging institutional and retail demand for regulated crypto exposure.

A zero-fee structure for the first six months has been pivotal in attracting capital, eliminating management costs that typically erode returns in competing crypto ETFs. The fund sources XRP exclusively from regulated exchanges and OTC desks, ensuring compliance and transparency—a key differentiator in a market wary of unregulated platforms.

Ripple Labs’ participation as a seed investor adds institutional credibility, signaling confidence in the product’s viability. This endorsement aligns with broader industry trends of traditional finance embracing digital assets through compliant vehicles.

XRP Price Prediction: $38 Target Gains Traction Amid Technical Breakout Signals

XRP's market trajectory is drawing intense scrutiny after analyst Gert van Lagen identified a rare confluence of bullish chart patterns. The 7-year double bottom and ascending triangle formation, historically precursors to major rallies, suggest potential upside toward $38—a target that would require a market capitalization exceeding $2 trillion.

Current price action shows XRP consolidating above critical support at $2.80, having weathered months of sideways movement below $2.40. Van Lagen's analysis, referencing Investopedia's studies on pattern reliability, indicates confirmed double bottoms often precede 2x gains or greater. The $38 projection stems from measuring the patterns' technical implications against XRP's historical breakout behavior.

Market participants remain divided on feasibility given Ripple's ongoing SEC litigation. Yet the technical case gains credence from XRP's demonstrated resilience—the asset has maintained key support levels despite regulatory uncertainty, with its $173.9 billion valuation positioning it among crypto's elite.

SBI CEO Highlights XRP's Role in Global Wealth Transfer Amid Macroeconomic Shifts

Tomoya Asakura, CEO of SBI Global Asset Management, has positioned XRP as a cornerstone in a generational wealth transfer. In a recent social media post, Asakura dismissed the token's speculative reputation, framing it instead as foundational to the future of global finance.

Macroeconomic turbulence—rising tariffs, inflation, and geopolitical strife—is accelerating capital flight from traditional assets toward cryptocurrencies and gold. XRP stands out with its real-world utility in cross-border payments, bolstered by low fees and rapid settlement times.

Ripple's institutional adoption strategy further validates XRP's case. The fintech firm has woven the token into a global payment network embraced by banks, distinguishing it from narrative-driven peers.

XRP Rally Sparks Market Optimism as ETF Prospects and Whale Accumulation Fuel Growth

Ripple's XRP has surged over 30% in the past week, breaching the $3 psychological barrier for the first time in four months. The rally coincides with growing institutional interest, highlighted by Grayscale's approval to convert its XRP-heavy Digital Large Cap Fund into an ETF—a move tempered by lingering regulatory uncertainties.

On-chain data reveals accelerating accumulation by major holders, with wallets containing 100 million to 1 billion XRP expanding positions since July. The broader crypto market cap now stands at $3.74 trillion, creating fertile ground for what analysts describe as a 'perfect storm' of technical and fundamental drivers.

Market watchers now eye a potential all-time high for XRP, with $4 appearing increasingly plausible. 'When whales accumulate and institutions position simultaneously, you get these explosive moves,' noted one trader, speaking on condition of anonymity.

Ripple News: Is It the Right Time to Buy XRP?

Search interest in "Buy XRP" has surged as the XRP community anticipates the ProShares XRP Futures ETF launch on July 18. The token has already rallied 445% over the past year, sparking debates about optimal entry points.

Historical patterns suggest search volume spikes often follow price rallies rather than precede them. Google Trends data shows current "Buy XRP" queries at multi-month highs, though still below 2017-2018 levels when XRP saw parabolic moves.

The ProShares ETF introduction contrasts with today's price weakness, creating market dissonance. Between 2022-2023, XRP delivered substantial returns during periods of low search activity, indicating retail interest frequently lags institutional moves.

XRP Bull Run Heats Up: Key Resistance At $3.65 Could Unlock $15

XRP has surged past its consolidation phase, now trading at $2.86 with robust bullish momentum. The asset's recent climb from the $2.35–$2.50 accumulation zone to a local high of $2.96 signals renewed investor confidence. A brief pullback suggests early profit-taking, but the overall trajectory remains upward.

Technical indicators reinforce optimism. Exponential moving averages align bullishly, with EMA 20 at $2.48 and longer-term averages trending lower. The $3.65 resistance level emerges as a critical threshold—a decisive break could trigger a macro breakout toward $15, putting XRP within striking distance of its $3.84 all-time high from January 2018.

Market watchers note the parabolic move carries typical sustainability concerns. The next immediate hurdles lie at $2.96 and the psychological $3.00 barrier, with extension targets between $3.25–$3.50 if momentum holds. Eight years after its last peak, XRP's resurgence reflects growing institutional interest in digital assets beyond Bitcoin and Ethereum.

Will XRP Price Hit 3?

Based on current technicals and news sentiment, XRP has a high probability of testing the $3 resistance level soon. The price is already near the upper Bollinger Band (3.0089), and bullish news catalysts like ETF inflows and institutional interest could push it higher.

| Indicator | Value | Implication |

|---|---|---|

| Price | 2.9053 USDT | Near resistance |

| 20-day MA | 2.4382 | Support level |

| Bollinger Upper | 3.0089 | Key target |